Oil isn’t supposed to be the story in 2026. The macro narrative powering “cuts soon, liquidity soon” trades relies on disinflation staying intact.

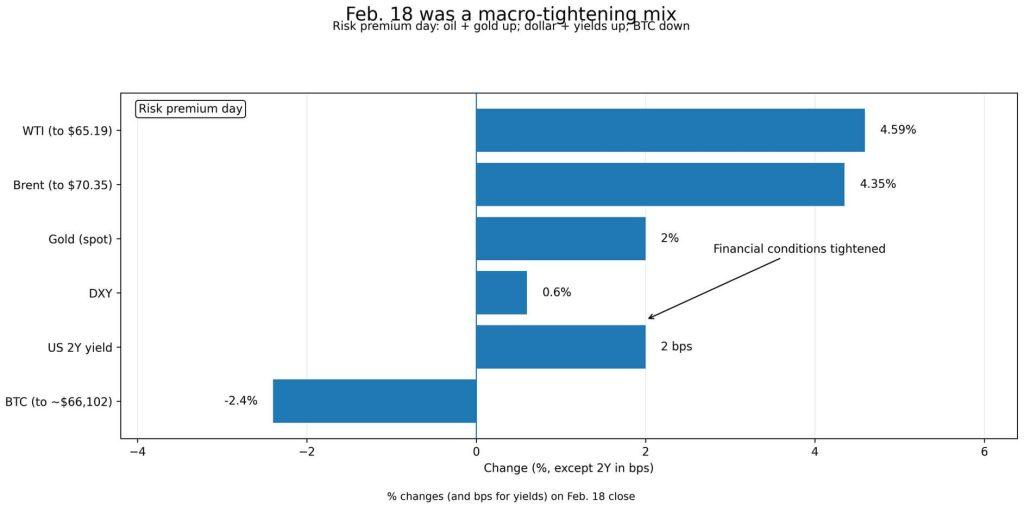

However, Brent jumped 4.35% to $70.35 on Feb. 18, and WTI surged 4.59% to $65.19 after headlines revived the risk of a US-Iran conflict and Russia-Ukraine talks ended without breakthroughs.

This isn’t just an “oil traders” print. It’s a rates print, and by extension, a Bitcoin print.

Bitcoin doesn’t trade barrels. It trades the path of financial conditions. When oil moves on supply-disruption fear, it hits the exact pressure points that keep rates higher for longer.

Risk premium, not demand

The jump wasn’t “growth is accelerating.” It was geopolitics injecting a premium into the curve.

Late-session buying accelerated after Israel raised alert levels on indications of possible US action against Iran. Iran’s Revolutionary Guard conducted drills that temporarily closed parts of the Strait of Hormuz.

Russia-Ukraine peace talks in Geneva failed to produce progress.

The US Energy Information Administration estimates that oil flows through the Strait averaged approximately 20 million barrels per day in 2024, about 20% of global petroleum liquids consumption.

Traders don’t need sustained closure to reprice risk, only a plausible disruption at a bottleneck that large.

Oil price jumps do not necessarily indicate Bitcoin price movements. It creates a fork.

On one side, there’s the narrative that oil up pushes inflation expectations higher, yields climb, risk assets sell, and Bitcoin bleeds first. On the other hand, another narrative points to war-risk premium bids for a hedge basket of oil, gold, and sometimes Bitcoin.

Feb. 18 showed which regime dominated. Gold jumped roughly 2%, the dollar index rose, Treasury yields pushed higher, and Bitcoin dropped 2.4% to around $66,102.37.

That combination appears to be “tightening conditions,” not “Bitcoin as hedge.”

Oil breaks disinflation, the Fed gets less patient

Oil shocks disrupt the disinflation process because energy affects transportation and input costs quickly.

San Francisco Fed research from December 2025 finds that the two-year Treasury yield has been more sensitive to oil supply surprises in recent years than in the pre-2021 period. That matters for Bitcoin because the two-year yield is the market’s shorthand for “how many cuts, how soon.”

When oil rallies for supply-risk reasons, markets ask “does this re-stick inflation?”

The “cut season” trade is fragile. If energy headlines keep Brent elevated, markets reprice toward fewer cuts, pushing the dollar higher, real yields higher, and risk appetite lower.

Bitcoin often gets hit harder than equities when leverage is crowded and macro conditions tighten.

Three scenarios forward

There are three potential scenarios ahead for Bitcoin.

The first scenario happens if the risk premium fades. Diplomacy cools tensions, Hormuz disruption risk recedes, Brent drifts toward mid-$60s.

Citi has argued that de-escalation could pull Brent down toward $60-62 by mid-2026. That reopens the disinflation narrative and revives the cuts-soon trade. Bitcoin benefits as financial conditions ease.

This is the most bullish path.

The second scenario happens if the risk premium sticks. Brent holds $65-$70 as geopolitical tensions remain unresolved.

Central banks stay cautious about cutting aggressively. Bitcoin can rally on crypto-specific flows but fights macro headwinds. The “higher for longer” rate environment caps upside.

The third scenario manifests as an escalation of tail risk. Eurasia Group estimates a 65% probability of US strikes against Iran by the end of April.

Hormuz disruption could spike prices. Bitcoin faces its sharpest tension: hedge fund demand pulling one way, rate shock pressure pulling the other.

If oil prices reach $80 or $90, inflation expectations rise, yields surge, and financial conditions tighten sharply.

| Scenario | Oil path (Brent range) | Macro transmission (breakevens / 2Y / DXY) | Policy implication (cuts) | BTC behavior (risk vs hedge) | What to watch next (1–2 indicators) |

|---|---|---|---|---|---|

| Risk premium fades | Mid-$60s drift; Citi $60–62 | Breakevens cool; 2Y eases; DXY softens as conditions loosen | Cuts back on the table sooner / more cuts priced | BTC behaves more risk-on (liquidity-sensitive); rallies as “cuts soon” returns | Brent breaks below ~$65 and stays there; 2Y rolls over (cuts re-priced in) |

| Risk premium sticks | $65–70 range | Breakevens sticky; 2Y stays elevated; DXY firm | Cuts delayed / fewer cuts; “higher for longer” vibe | BTC can rally on crypto flows but macro caps upside; trades like risk most days | Brent holds >$70 on closes; DXY trends up (tightening) |

| Escalation tail risk | $80–90 spike | Breakevens jump; 2Y pops; DXY spikes (risk-off tightening) | Cuts get pushed out sharply; risk of renewed hawkishness | BTC faces identity crisis: brief “hedge” bid possible, but rate shock usually makes it trade like risk | Hormuz headlines + backwardation widens; breakevens surge alongside oil |

What this means for Bitcoin traders

The EIA forecasts Brent averaging $58 in 2026, driven by supply exceeding demand.

Current prices embed a geopolitical premium that analysts estimate at $4-$7 per barrel. Without conflict risk, crude would trade in the high $50s, given the International Energy Agency’s projected 3.7 million barrel-per-day surplus.

For the US two-year yield, upward movement indicates that cuts have been pushed out. If yields climb as oil stays elevated, the market is pricing a tighter policy for longer.

For breakevens, what matters is whether inflation expectations rise with oil. That’s the disinflation narrative stress test.

Additionally, a stronger dollar equals tighter conditions. On Feb. 18, DXY rose alongside oil and gold, which is a classic “macro tightening” mix.

Feb. 18 looked risk-like, with Bitcoin down while gold climbed. If Bitcoin rises alongside gold while yields stabilize, the hedge narrative is back.

Besides, DeFi, halving cycles, and ETF flows matter.

Yet, on days like Feb. 18, Bitcoin is trading the same question as everything else: does this oil move force the Fed to stay tight?

The uncomfortable truth is that Bitcoin’s macro identity remains in flux.

It wants to be digital gold when geopolitics flare. However, it trades like leveraged tech when rates drive the narrative.

The asset can’t be both simultaneously, and oil shocks force the market to choose. Currently, when oil rises due to supply risk and pushes inflation fears higher, Bitcoin sells alongside risk assets rather than rallying with gold.

The next two weeks matter.

Iran returns to Geneva with a new proposal. Russia and Ukraine continue talks. India’s oil purchasing decisions get clarified.

Each variable feeds into the Brent curve, which feeds into inflation expectations, which feeds into the two-year yield, which determines whether “cuts soon” stays alive.

Bitcoin’s path follows that chain. Oil isn’t supposed to be the story, but sometimes the story you weren’t watching is the one that moves the market.

The post Bitcoin faces a new selloff if oil holds $70 after spike and the Fed turns less patient appeared first on CryptoSlate.